If you expect to receive at least one of the following payments for your business from the Canada Revenue Agency, you can sign up for direct deposit: corporation income tax refund goods and services tax/harmonized sales tax refund refund of excise tax or other levies. Start Direct Deposit. Change Direct Deposit End Direct Deposit Day Month Year. Day Month YearC - FINANCIAL INSTITUTION INFORMATION. DIRECT DEPOSIT ROUTING NUMBER. Name(s) of the other Account Holder(s) if a joint account.

The manage direct deposit service is currently unavailable in our CRA login services. You can still enrol directly through your financial institution.

Don't miss a payment!

Direct deposit is fast, convenient and secure. Register for direct deposit today to ensure you get your payments on time in the event of an emergency or unforeseen circumstances!

For more information and to find out how to update your account, please visit our Frequently asked questions about direct deposit.

Individuals

If you receive one of the following payments from the CRA and have a Canadian bank account, you can sign up for direct deposit:

- income tax refund

- goods and services tax/harmonized sales tax credit and any similar provincial and territorial payments

- Canada child benefit and any similar provincial and territorial payments

- Canada workers benefit

- deemed overpayment of tax

Note

If you have already signed up for direct deposit with the CRA, we will use the existing bank account information for any payments you are entitled to receive.

How to sign up

Online

You can sign up yourself if you are registered for My Account. If you are not yet registered, why wait? My Account can help you quickly and easily manage your tax affairs online, including signing up for direct deposit or changing your account information.

You can also see if you have any uncashed cheques that are older than six months.

Online - mobile application

To start or update direct deposit information, use MyCRA.

New Sign up through more financial institutions

You can now sign up for direct deposit or change your account information through many financial institutions.

Choose your financial institutionBanks (individuals)

- Alterna Bank Alterna Savings and Credit Union Limited Alterna Savings

- ATB Financial Alberta Treasury Branches

- BMO Bank of Montreal

- Canadian Western Bank CWB Financial Group

- CIBC Canadian Imperial Bank of Commerce

- HSBCHSBC Bank Canada

- Laurentian Bank Laurentian Bank of Canada LBC

- LBC Digital Laurentian Bank of Canada

- National Bank National Bank of Canada

- RBC Royal Bank of Canada

- Scotiabank Bank of Nova Scotia

- TD Canada Trust Toronto-Dominion Bank TD Bank

Credit unions and trust companies (individuals)

- ABCU Alberta's Credit Union

- Alterna Savings Alterna Savings and Credit Union Limited Alterna Bank

Once you provide consent through one of these financial institutions, your CRA direct deposit information will be updated the following day. We encourage you to visit your financial institution's website for information on how to sign up.

By phone

To sign up for direct deposit or to change your account information, call CRA at 1-800-959-8281. You will need your:

- social insurance number

- full name and current address, including postal code

- date of birth

- most recent income tax and benefit return and information about the most recent payments you received from the Canada Revenue Agency

- banking information: three-digit financial institution number, five-digit transit number, and your account number

Do not close your old bank account until your first payment has been deposited to your new bank account as it may already be in process.

BusinessesIf you expect to receive at least one of the following payments for your business from the Canada Revenue Agency, you can sign up for direct deposit:

- corporation income tax refund

- goods and services tax/harmonized sales tax refund

- refund of excise tax or other levies

- refund of payroll deductions

- Canada Emergency Wage Subsidy (CEWS)

How to sign up

Online

As a business owner or delegated authority, you can start or update a direct deposit online.

To complete your direct deposit application or to manage your direct deposit information, log in or register for:

New Sign up through financial institutions

The CRA may contact you by phone to confirm information. If you have questions about a call you receive, you may read more about how to recognize scams.

You can now sign up for direct deposit for certain business accounts or change your account information through your financial institution. To be eligible to enroll for CRA direct deposit for businesses, your business must have a valid 15 digit business number and one of the following CRA program accounts:

- RT – Goods and Services Tax/Harmonized Sales Tax

- RP – Payroll

- RC – Corporate Income Tax

- ZA - Canada Emergency Rent Subsidy (CERS)

* Note: You will need to sign up your Canada Emergency Rent Subsidy account (ZA) to receive the CERS by direct deposit.

Choose your financial institutionBanks (businesses)

- BMO Online Banking Bank of Montreal or BMO Online Banking for Business Bank of Montreal

- Canadian Western Bank CWB Financial Group

- CIBC online banking Canadian Imperial Bank of Commerce or CIBC Cash Management Online Canadian Imperial Bank of Commerce

- HSBC HSBC Bank Canada

- Laurentian Bank (coming soon)

- RBC Royal Bank of Canada

- Scotiabank Bank of Nova Scotia

- TD Canada Trust Toronto-Dominion Bank TD Bank

Credit unions and trust companies (businesses)

TrustsIf you are the trustee, custodian, executor, or other type of legal representative for a trust, you can start or change direct deposit information. The name on the bank account must match the name of the trust.

How to sign up

By mail

- Fill out Form T3-DD, Direct Deposit Request for T3.

- Mail the completed form to the address on the form.

For more information about direct deposit for trusts, call 1-800-959-8281.

Non-residentsEi Direct Deposit Form

You can start direct deposit or change your banking information related to direct deposit if the following conditions apply:

- you are a Canadian payer or agent

- your non-resident tax account has three alpha characters starting with NR followed by six digits

- your Canadian bank account is registered in Canada

- the name on your Canadian bank account matches the name on your non-resident tax account

If you are a non-resident of Canada filing a Form NR7-R, Application for Refund of Part XIII Tax Withheld, you can ask the Canada Revenue Agency to deposit your refund directly into your bank account at a Canadian financial institution. The name on the bank account must match the name of the applicant or the authorized person who signs the certification section on Form NR7-R.

How to sign up

By mail

Non-resident account holder

- Fill out Form NR304, Direct Deposit Request for Non-Resident Account Holders and NR7-R Refund Applicants.

- Mail the completed form to the address on the form.

NR7R refund applicant

- Fill out Form NR304, Direct Deposit Request for Non-Resident Account Holders and NR7-R Refund Applicants.

- Attach the completed NR304 to the Form NR7-R, Application for Refund of Part XIII Tax Withheld refund application.

- Mail the completed forms to the address on the forms.

For more information about direct deposit for non-resident account holders and NR7-R refund applicants, call 1-855-284-5946.

Report a problem or mistake on this pageThank you for your help!

Game app make money. You will not receive a reply. For enquiries, contact us.

- Date modified:

随着今天 Discover Checking $300 开户奖励的大潮,很多人问起了什么是 Direct Deposit (DD)。希望这篇小文可以给大家讲明白这个问题。为了让这个概念更加清晰,我们分为真正的Direct Deposit和擦边球两个部分来讲解。

1. 真正的 Direct Deposit

真正的 Direct Deposit 是指你的工资(Payroll)、社会救济(Social Security)、退休金(Pension)和政府福利(Government benefits)这四种类型的收入直接打入银行账户的操作。对决大多数人来说就只有工资(Payroll)可以完成真正的 Direct Deposit。

If you receive one of the following payments from the CRA and have a Canadian bank account, you can sign up for direct deposit:

- income tax refund

- goods and services tax/harmonized sales tax credit and any similar provincial and territorial payments

- Canada child benefit and any similar provincial and territorial payments

- Canada workers benefit

- deemed overpayment of tax

Note

If you have already signed up for direct deposit with the CRA, we will use the existing bank account information for any payments you are entitled to receive.

How to sign up

Online

You can sign up yourself if you are registered for My Account. If you are not yet registered, why wait? My Account can help you quickly and easily manage your tax affairs online, including signing up for direct deposit or changing your account information.

You can also see if you have any uncashed cheques that are older than six months.

Online - mobile application

To start or update direct deposit information, use MyCRA.

New Sign up through more financial institutions

You can now sign up for direct deposit or change your account information through many financial institutions.

Choose your financial institutionBanks (individuals)

- Alterna Bank Alterna Savings and Credit Union Limited Alterna Savings

- ATB Financial Alberta Treasury Branches

- BMO Bank of Montreal

- Canadian Western Bank CWB Financial Group

- CIBC Canadian Imperial Bank of Commerce

- HSBCHSBC Bank Canada

- Laurentian Bank Laurentian Bank of Canada LBC

- LBC Digital Laurentian Bank of Canada

- National Bank National Bank of Canada

- RBC Royal Bank of Canada

- Scotiabank Bank of Nova Scotia

- TD Canada Trust Toronto-Dominion Bank TD Bank

Credit unions and trust companies (individuals)

- ABCU Alberta's Credit Union

- Alterna Savings Alterna Savings and Credit Union Limited Alterna Bank

Once you provide consent through one of these financial institutions, your CRA direct deposit information will be updated the following day. We encourage you to visit your financial institution's website for information on how to sign up.

By phone

To sign up for direct deposit or to change your account information, call CRA at 1-800-959-8281. You will need your:

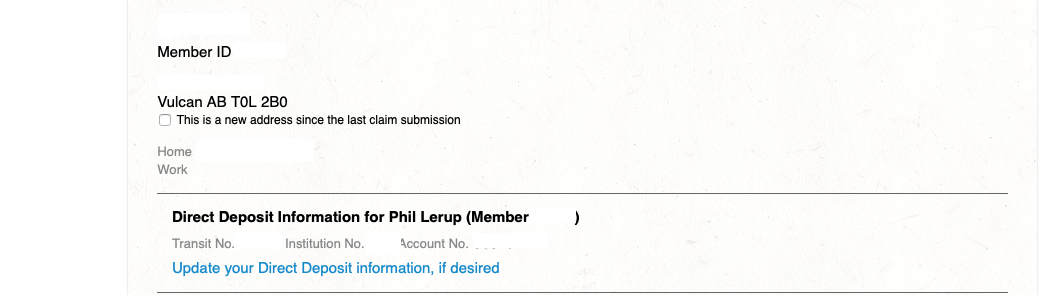

- social insurance number

- full name and current address, including postal code

- date of birth

- most recent income tax and benefit return and information about the most recent payments you received from the Canada Revenue Agency

- banking information: three-digit financial institution number, five-digit transit number, and your account number

Do not close your old bank account until your first payment has been deposited to your new bank account as it may already be in process.

BusinessesIf you expect to receive at least one of the following payments for your business from the Canada Revenue Agency, you can sign up for direct deposit:

- corporation income tax refund

- goods and services tax/harmonized sales tax refund

- refund of excise tax or other levies

- refund of payroll deductions

- Canada Emergency Wage Subsidy (CEWS)

How to sign up

Online

As a business owner or delegated authority, you can start or update a direct deposit online.

To complete your direct deposit application or to manage your direct deposit information, log in or register for:

New Sign up through financial institutions

The CRA may contact you by phone to confirm information. If you have questions about a call you receive, you may read more about how to recognize scams.

You can now sign up for direct deposit for certain business accounts or change your account information through your financial institution. To be eligible to enroll for CRA direct deposit for businesses, your business must have a valid 15 digit business number and one of the following CRA program accounts:

- RT – Goods and Services Tax/Harmonized Sales Tax

- RP – Payroll

- RC – Corporate Income Tax

- ZA - Canada Emergency Rent Subsidy (CERS)

* Note: You will need to sign up your Canada Emergency Rent Subsidy account (ZA) to receive the CERS by direct deposit.

Choose your financial institutionBanks (businesses)

- BMO Online Banking Bank of Montreal or BMO Online Banking for Business Bank of Montreal

- Canadian Western Bank CWB Financial Group

- CIBC online banking Canadian Imperial Bank of Commerce or CIBC Cash Management Online Canadian Imperial Bank of Commerce

- HSBC HSBC Bank Canada

- Laurentian Bank (coming soon)

- RBC Royal Bank of Canada

- Scotiabank Bank of Nova Scotia

- TD Canada Trust Toronto-Dominion Bank TD Bank

Credit unions and trust companies (businesses)

TrustsIf you are the trustee, custodian, executor, or other type of legal representative for a trust, you can start or change direct deposit information. The name on the bank account must match the name of the trust.

How to sign up

By mail

- Fill out Form T3-DD, Direct Deposit Request for T3.

- Mail the completed form to the address on the form.

For more information about direct deposit for trusts, call 1-800-959-8281.

Non-residentsEi Direct Deposit Form

You can start direct deposit or change your banking information related to direct deposit if the following conditions apply:

- you are a Canadian payer or agent

- your non-resident tax account has three alpha characters starting with NR followed by six digits

- your Canadian bank account is registered in Canada

- the name on your Canadian bank account matches the name on your non-resident tax account

If you are a non-resident of Canada filing a Form NR7-R, Application for Refund of Part XIII Tax Withheld, you can ask the Canada Revenue Agency to deposit your refund directly into your bank account at a Canadian financial institution. The name on the bank account must match the name of the applicant or the authorized person who signs the certification section on Form NR7-R.

How to sign up

By mail

Non-resident account holder

- Fill out Form NR304, Direct Deposit Request for Non-Resident Account Holders and NR7-R Refund Applicants.

- Mail the completed form to the address on the form.

NR7R refund applicant

- Fill out Form NR304, Direct Deposit Request for Non-Resident Account Holders and NR7-R Refund Applicants.

- Attach the completed NR304 to the Form NR7-R, Application for Refund of Part XIII Tax Withheld refund application.

- Mail the completed forms to the address on the forms.

For more information about direct deposit for non-resident account holders and NR7-R refund applicants, call 1-855-284-5946.

Report a problem or mistake on this pageThank you for your help!

Game app make money. You will not receive a reply. For enquiries, contact us.

- Date modified:

随着今天 Discover Checking $300 开户奖励的大潮,很多人问起了什么是 Direct Deposit (DD)。希望这篇小文可以给大家讲明白这个问题。为了让这个概念更加清晰,我们分为真正的Direct Deposit和擦边球两个部分来讲解。

1. 真正的 Direct Deposit

真正的 Direct Deposit 是指你的工资(Payroll)、社会救济(Social Security)、退休金(Pension)和政府福利(Government benefits)这四种类型的收入直接打入银行账户的操作。对决大多数人来说就只有工资(Payroll)可以完成真正的 Direct Deposit。

Ei Direct Deposit Dates 2021

其实这是个很方便的事情,有了它就不再需要每个月收支票存工资了。银行也很喜欢 Direct Deposit,因为大部分人都比较懒,设置了一次之后很少有人会去改成别的银行的,因此银行就可以一直收钱了,所以他们很喜欢在 Checking Account 的开户奖励上面要求 Direct Deposit。

具体的操作步骤随着不同的单位而异,一般情况下有两种选择:

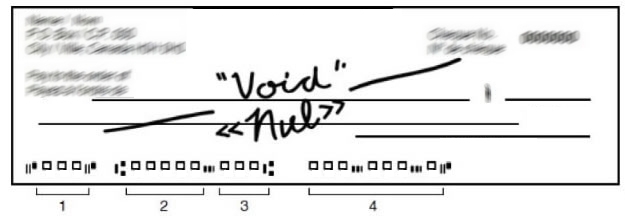

- 联系你负责发工资的小秘寻求帮助。他们一般都懂怎么做。主要步骤就是给你一张表,你填一下你的银行信息,并且附上一张自己写上『VOID』字样的银行支票,然后交给小秘处理就好了。

- Google一下你的单位名称 + Direct Deposit,也许会有指示告诉你如何网上操作,比如这个网页就是UCSD的操作说明。

需要强调的一点是,以下操作均不被算作 Direct Deposit:现金存款、存支票、自己的银行账户间转账、其他个人转来的转账。

2. 擦边球

虽然严格定义的 Direct Deposit 只有上述说的那些,但是实际操作中,因为有的银行系统在分辨工资和普通的银行间转账上面有一定困难,导致有的银行账户之间的转账也被算作了 Direct Deposit。此类擦边球称为 fake DD。每个银行对这种情况的分辨能力都是不同的,因此没有一个通用的法则告诉你哪些转账算 Direct Deposit 哪些不算。在这方面总结的最好的当属 Doctor of Credit 的这个页面,他会收集网络上的各种数据来不断完善这个页面。

我想说的是,如果你有条件用工资设置真正的 Direct Deposit,就不要用这种擦边球的办法,因为银行系统随时在更新,稍微久远一点的数据点可能现在都不可信了。尤其是 Discover Checking 以前没有过需要 Direct Deposit 才给的开户奖励,所以目前网上并没有关于它的任何数据点,只有靠大家借着这波开户奖励来积累数据点了。